Sovereign blockchain data infrastructure for regulated finance.

LedgerCore turns raw chain and exchange activity into audit‑grade, explainable records — exposed via a unified API and private AI assistant, deployable on‑prem or as managed cloud.

What is LedgerCore

One horizontal engine that ingests from full archival nodes, exchanges and OSINT, then normalizes to double-entry semantics, enriches with labels, risk and events, and serves it all via a unified API and private MCP server.

Sovereign by design

Deploy on‑prem or as managed cloud with identical schemas and pipelines. Keep sensitive workloads inside your perimeter.

Transparent lineage

Direct from full archival nodes and authenticated exchange APIs - deterministic processing, verifiable to TxID/block height.

One engine, many apps

LedgerCore powers LedgerWatch (oversight & investigations), LedgerTax (accounting, audit & tax), and investor‑grade DAT dashboards.

Implementations

Real systems built on the Ledgercore data plane for investigations, reporting, and risk.

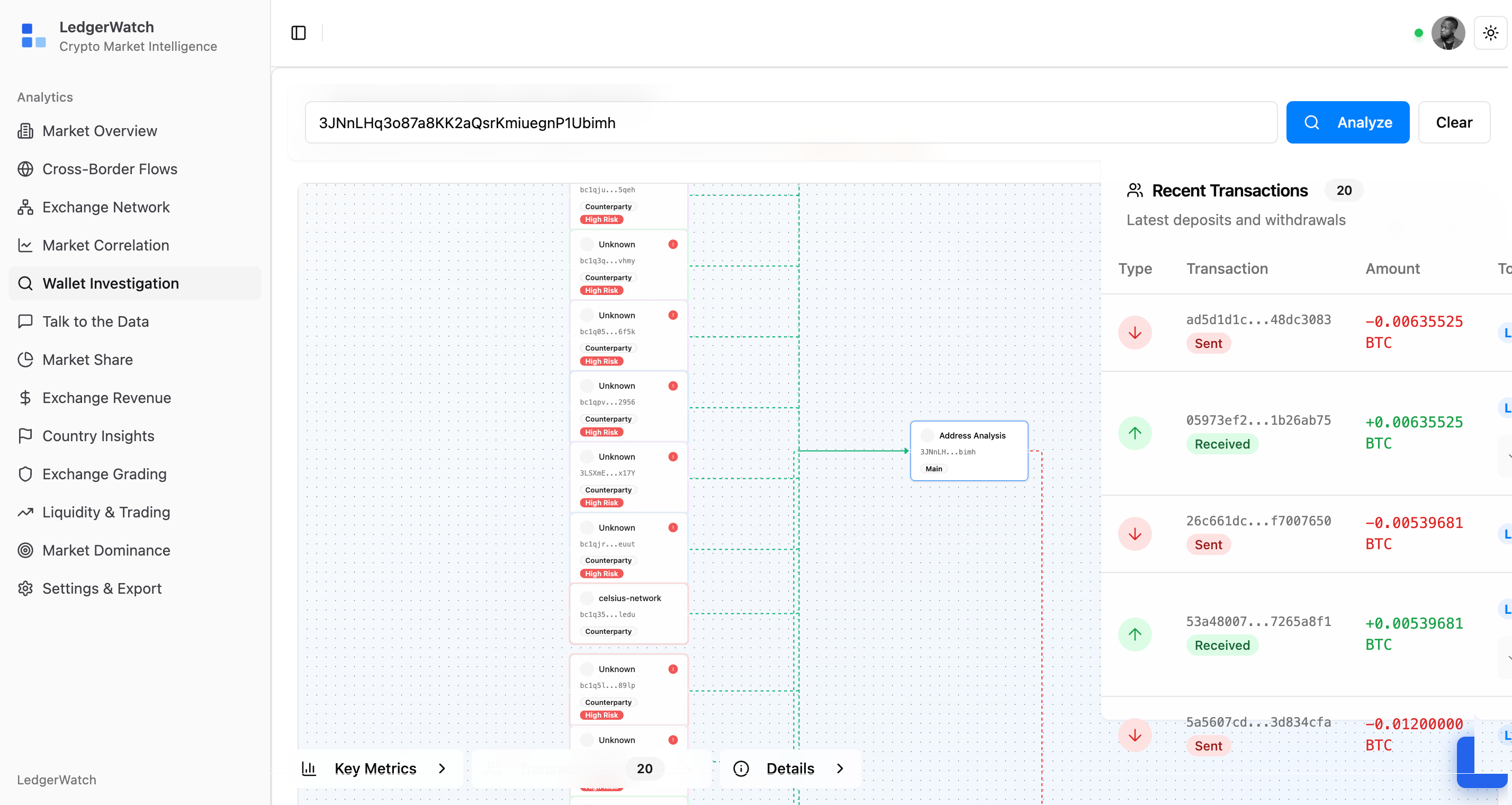

LedgerWatch

Cross‑border flows, exchange oversight, wallet investigations; configurable risk scoring and white labeled PDF exports.

Law Enforcement & Regulators · Bank AML/CTF · Exchange ComplianceExplore nowKey Outcomes

- Identify counterparties and exposure across hops

- Monitor cross‑border flows and jurisdictional risk

- Track exchange inflows/outflows, trade activity, and market dominance

Key Capabilities

- Transaction graph with entity clustering and risk tags

- Country flow view (inflow vs outflow) with time windows

- Exchange monitoring: listings, inflow spikes, wash‑trade heuristics

- Case files with timelines, notes, and export for SAR/STR workflows

The LedgerCore Engine

Our blockchain intelligence platform ingests data from full nodes, exchanges, sanctions lists and OSINT, normalizes it into double-entry semantics, enriches it with labels, risks and smart-contract events, and exposes the results as actionable insights through a unified API and private MCP server.

Direct‑from‑source

Our own nodes + authenticated exchange integrations; no third‑party aggregators.

Audit‑grade schema

Debits/credits, assets/liabilities, running balances across addresses and entities.

100+ analytics

Cross‑border flows, sanctions exposure, DeFi/event traces, market correlation, regulated reference pricing, KYT, PoR, accounting/tax.

Data Sources

LedgerCore Engine

Data Refinery & Intelligence Hub

Unified API & MCP

Actors & Applications

Data methodology

How we guarantee accuracy, repeatability, and trust—by design.

Block‑height provenance

Tamper‑evident provenance to block height & exchange TxIDs. Stored procedures and test coverage for stable read‑paths.

Deterministic transforms

Reproducible pipelines with versioned decoders and transformation steps, built for bulk queries & historical balances.

Multi‑chain + off‑chain

Full historic data (public & authenticated), smart‑contract events, protocol variables, sanctions & OSINT, and market feeds.

Why We Win

When accuracy, explainability, and control matter, Ledgercore delivers a single, enterprise‑ready path from raw blockchain activity to audit‑grade outputs – deployed where you need it and verifiable down to the TxID.

On‑prem sovereignty

Only platform with a true on‑prem option — a governed, private data plane for banks, auditors, and regulators.

Horizontal foundation

One engine powering investigations, audit/tax, and market intelligence — fewer silos, faster delivery.

Direct‑from‑source integrity

Full nodes and user‑authenticated exchange data. Transparent, verifiable lineage vs. opaque data aggregators.

One horizontal platform

A unified engine for all use cases (LedgerWatch, LedgerTax, Ledgernalysis), so enrichment, reconciliation, and governance live in one place – no silos.

Unified API Layer

Access hundreds of analytics directly from our unified API — from cross‑border flows and sanctions exposure to market correlation, accounting, PoR, KYT & Travel Rule. Plug in programmatically or pair with the MCP assistant for natural‑language queries.

Direct access

Consume exactly what you need. Use REST/SDKs to integrate our normalized data and computed analytics into your systems.

GET /api/v1/flows/cross-border?asset=USDT&from=ZA&to=US

Rich catalog

Stablecoins, market overviews, exchange analytics & orderbooks, DeFi events, country insights, labeled wallets, accounting & tax, proof‑of‑reserves, and more.

Governed & private

On‑prem deployment: your apps talk to a sovereign API behind your firewall. Cloud: we host and secure the pipeline and gateway for you.

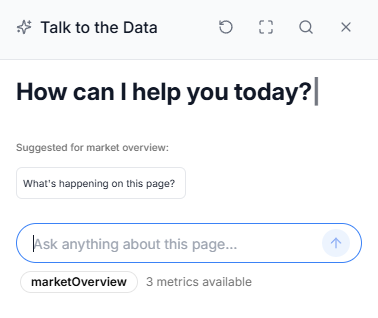

Talk to the Data (MCP)

Private AI assistant for natural‑language queries, automated reporting, and code/dashboard scaffolding. Deployable on‑prem with your data.

What our partners say

Proof points from teams running sovereign, verifiable data planes with one horizontal platform.

Ledgercore delivered unmatched blockchain expertise, agility, and a commitment to excellence that surpassed our expectations.

Ledgercore was selected out of over 50 proposals to work on research and development of a central hub for open-source software for proof of reserves.

Featured Resources

Stay informed with news,expert insights on blockchain technology, regulatory compliance, and the evolving landscape of digital asset management.

The Evolution of Blockchain Forensics

Advanced techniques in blockchain analysis are revolutionizing how financial crimes are investigated, providing unprecedented transparency in digital asset tracking.

Know Your Transactions: The Future of Compliance

KYT protocols are becoming essential for financial institutions to monitor real-time transaction flows and ensure regulatory compliance in the digital asset ecosystem.

Turn blockchain data into answers.

We have unmatched blockchain intelligence. From wallet investigations to treasury reporting – see how Ledgercore turns raw activity into decision‑ready analysis in minutes.

Contact Ledgercore

Have questions or ready to get started with Ledgercore? Send us a message and we'll respond as soon as possible.

Let's Start a Conversation

Whether you're looking to streamline your workflow, boost productivity, or transform your business operations, we're here to help you succeed.